Free Pro Forma Family Cash Flow Template Download Available for Download in PDF, Google Sheet, EXCEL Format. Download PDF Download Google Sheet Download EXCEL. Pro Forma Family Cash Flow Template Preview. Sample Pro F'orma and Guide. Single-Family Rental Development. BiggerPockets Wealth Magazine. Written by financial journalists and data scientists, get 60+ pages of newsworthy content, expert-driven advice, and data-backed research written in a clear way to help you navigate your tough investment decisions in an ever-changing financial climate! Cash Flow = NOI – Debt Service = $7,000 – $5,760 = $1,240 So, after all is said and done, our profit on this house is $1,240 per year. That’s just over $100/month, which is about the minimum you should be looking for in a rental (any less and you risk losing money if any of your income or expenses assumptions prove too optimistic). Mac os x little snitch deinstallieren. Hi Ryan, I agree that a cash flow statement is a good way to see where you are with your income and expenses. I’d like to share a trick that I use to grow our family’s net worth; There is some income that I ignore when creating a cash flow statement so that it appears like we have less income to spend and can increase our savings. Jabulani Ngcobo bio: age, family, cashflow, cars, net worth, profile. 11 months ago by Kissa Wambugu. Jabulani Ngcobo, famously known as 'cashflow', is an entrepreneur in South Africa. He became known as one of the youngest millionaires in Durban by the age of 27 and as the CEO and founder of his foreign trading investment, Cashflow properties.

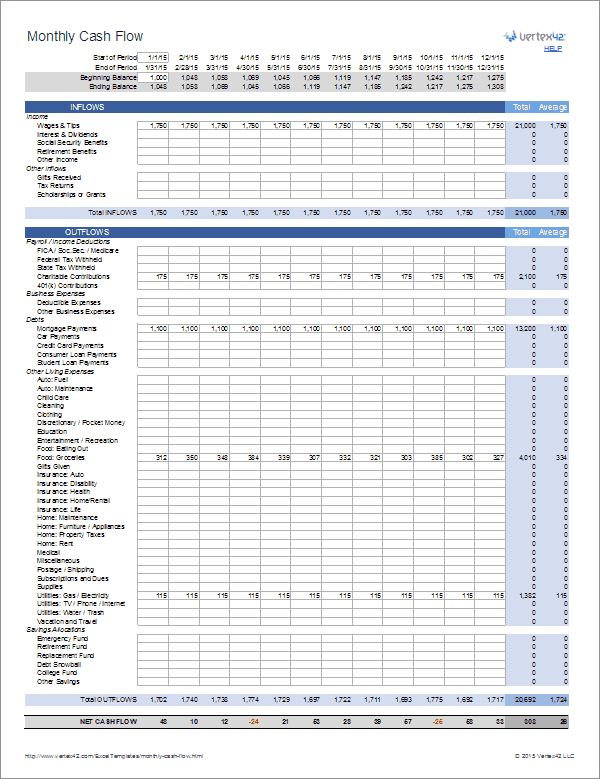

- Family Cash Flow Sheet

- Family Cash Flow Budget

- Family Cash Flow Template Excel

- Family Cash Flow Template

- Family Cash Flow Budget

Public companies are required to issue certain financial documents at regular intervals. On an annual basis, there is one document in particular that every investor should look out for: the cash flow statement.

This document allows shareholders to see how healthy the company is, and how well it has been managing their money. The company will also use these documents to craft new budgets for the next year.

The same strategy can be applied to your family finances. You want to stay on top of how healthy your money situation is and create realistic budgets as you consider diapers, college costs and extracurriculars this summer. Here’s how to plug your family’s numbers into a cash flow statement to evaluate your familial financial health.

What is a Cash Flow Statement?

Cash flow statements are typically issued once per year. Look at last year's numbers as you plan your budget for the next twelve months. This is a great tool to help you establish New Year’s Resolutions, but they can be done at any time.

Cash Flow from Operations

“Cash flow from operations” is a fancy way of talking about the money you brought in, and the cash you spent. Your family’s cash flow from operations may include:

- Net earnings from the parents’ day jobs.

- Additions to cash, or any other money you brought in. This could include things like credit card rewards and money brought in from side hustles. Your teenager’s babysitting income probably shouldn’t go in this section as it won’t get put into the family till, but if they used it to save for their own education or to put towards a vacation they really wanted to go on, feel free to count it.

- Subtractions from cash, or any money your family spent. This would include fun things like holiday or birthday presents, allowances, and extracurriculars. It would also include the boring stuff like insurance premiums, rent payments and utility bills. Just don’t include debt repayments—we’ll get into those a little later.

You’ll want to make sure any income you record is after taxes to give an accurate view of your financial situation.

Cash Flow from Investing

Unless you are in retirement, have a disabled dependent or have a child in college, your “cash flow from investing” section is likely to come up negative. But that’s a good thing; it means you’re using today’s money to invest in better tomorrows.

Office 365 E3 Microsoft Office 365 E3 Office 365 E3 is a cloud-based suite of productivity apps and services with information protection and compliance capabilities included. Install Office mobile apps on up to five PCs or Macs, five tablets, and five phones per user. How to set up an Office 365 E3/E5 trial account with Microsoft. Microsoft 365 E3 Microsoft 365 E3 combines best-in-class productivity apps with core security and compliance capabilities. Improve productivity and foster a culture of collaboration with connected experiences. Transform how you manage your business and enhance customer relationships with integrated workflows. Microsoft 365 E3 1 Access core products and features within Microsoft 365 to enhance workplace productivity and drive innovation, securely. $32.00 user/month. Microsoft 365 Business Premium Complete, integrated solutions designed for small business. $20.00 user/month. Microsoft 365 F1.

There will be two sections:

- Cash out. This will include any money you stashed into investments for the future. This frequently consists of retirement savings, 529 contributions, ABLE account contributions, real estate purchases, etc.

- Cash in. This is comprised of money you pull out of any of your investments. If you’re retired, it would include any monthly distributions you take. It would also cover money taken from a 529 and applied directly to your child’s education, or ABLE account withdrawals which are applied directly to the disabled family member’s needs.

Cash Flow from Financing

Have you collected money on a debt someone owes you? Or paid debt that you owe to someone else? If so, you’ll put it in the cash flow from financing section.

- Cash out. If you’ve paid on a mortgage, auto loan, student loan, or any other debt in the past year, put that amount here.

- Cash in. If you sell a car to your nephew arranging terms on a loan directly with you rather than through a lending institution, anything he’s paid towards the loan this year goes in this section. This is just one example of a way you may bring cash into your family coffers via financing. These situations will be few and far between for the average family.

The Jones Family Cash Flow Statement

Family Cash Flow Sheet

To get a better picture of what all this looks like when you’re done, we’re going to take a peek at the Jones family’s cash flow statement for the year. Joe Jones works part-time on the weekend and has an Etsy shop which occasionally sells some artwork, while his spouse, Sam, works full-time.

Family Cash Flow Budget

They have two daughters: Sarah started her freshman year of college in the fall, and Megan is a freshman in high school with Down’s Syndrome. The family uses an ABLE account to meet some of Megan’s expenses. They choose not to give their children an allowance.

With a final cash flow of -$4,372, the Jones family obviously needs to do better — even though they work hard to do the right things like maxing out their retirement accounts. The 0% interest intro offer on the credit card they’ve been using is going to expire in a couple months, and they don’t like being in debt to begin with. So they start evaluating their options.

Family Cash Flow Template Excel

Sarah’s 529 account won’t need anymore funding thanks to their diligent savings over the years. Her tuition and 529 withdrawals should continue to cancel each other out. While they could cut contributions to Megan’s ABLE account as they only used half of what they put in this year, it’s important to them to have money in the account into her adulthood—especially after they’re gone. So they decide to continue prioritizing it.

They talk with Sarah, and agree that she will pay for all of her ski trips and new clothes from here on out. They’re also going to cut back significantly on their habit of dining out, limiting the experience to once per month. While they’re not crossing the beach off the list forever, they decide to go on a more modest vacation closer to home in the next year.

Family Cash Flow Template

Get The Big Picture

Family Cash Flow Budget

A cash flow statement allows investors to get a big-picture idea of a company’s financial health. When you apply this same method to your family, you’ll illuminate blind spots you may have missed throughout the year, and you’ll be able to adjust your budget and spending accordingly.